Company:

GoodRx, $GDRX

Summary:

They work with pharmacies and earn a percentage of the sales price that the consumer buys from them using GoodRx’s coupon. They claim to have cumulatively saved $20b for consumers since founded.

They filed to go public on August 28, 2020. The company intends to go public on NASDAQ within 2020.

Competition:

I did not find any notable competition in terms of revenue generated. The closest competition (Trusted Tablets) had a revenue of $29m in 2019. GoodRx had a revenue of a whopping $388m in 2019. It makes it a clear leader in its field of medical prescription price comparison services.

Leadership:

Led by Douglas Hirsch as CEO. He has served in senior roles in Yahoo! and Facebook. His co-founder, Trevor Bezdek is a Stanford graduate and has strong consulting and healthcare experience. Their CFO is Karsten Voermann who only joined GoodRx in March 2020. He has a strong financial background.

Risks:

Change in the regulatory environment. US Medical system is highly complex. There are multiple players in the supply chain and the drug prices are not regulated. Any change to the regulations can directly affect GoodRx’s revenue or might force them to pivot which is not easy for a public company.

The founder has carried and executed a good vision for the company and is largely dependent on his execution. His departure in any form will have business consequences to GoodRx. While this risk exists for every startup/company, the revenue, and profitability of GoodRx are directly related to the founder’s execution.

A major percentage of GoodRx revenue comes from Pharmacy Benefit Managers. A shift in PBM’s business model will cause revenue loss to GoodRx.

Numbers:

GoodRx is strong in numbers. According to their S1 filing, they have seen +55% YoY growth between 2016-2019. They are already profitable with more than 40% EBITDA margins.

Benchmarking it with others is pretty difficult given a lack of competition among listed companies in this industry.

2020 six months ended June 30 Revenue: $256m

Guesstimates:

2025E Revenue: $1.87b (@ 30% YoY growth)

In my view, the figures above are quite conservative given their +55% YoY growth in the past 4 years. Continuing this momentum would mean a much higher revenue in 2025.

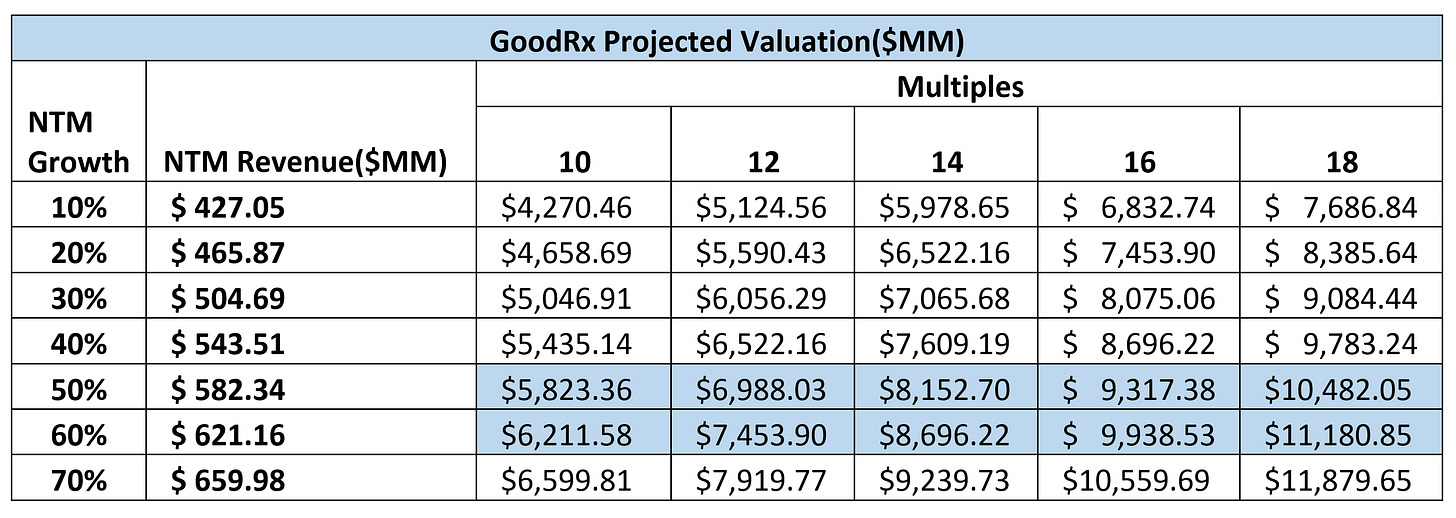

Using Last Twelve Month(LTM) revenue, $388m, and LTM growth, 55.6%, the Next Twelve Month(NTM) Revenue would be $604m. Considering SaaS companies’ median NTM multiples, lying between 10x-18x, GoodRx will trade at 14x NTM Revenue upon the first day of public trading, valuing the business at $8.5b.